Special Agent: Angola

by Caitlin Mann, Darcy Satkowiak and Sage Scherzer

ANGOLA, IN- On October 27, 2023, the Citizen Academy hosted an event for Trine University students to experience what a day in the life of an Internal Revenue Service special agent included. Criminal justice majors, forensic science and accounting majors participated in the simulation. Ten agents in the IRS organized and ran the event for 32 of Trine’s students.

To start the day, students were split into groups and given an imitation or fake case to solve. They were sworn in to be special agents and began working on their case. To solve their specific case, students were required to complete various tasks that modeled what real agents do in their career every day. Each tedious job was necessary to resolve the case. For example, students needed to conduct interviews, look at surveillance videos and form arguments to present in front of a magistrate for search and arrest warrants.

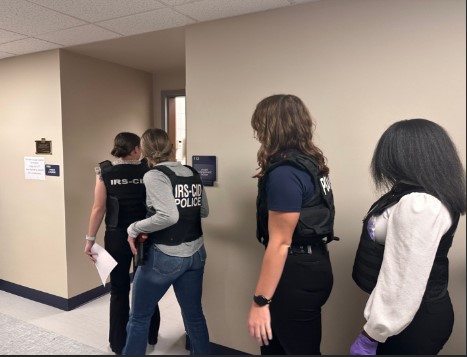

There were three groups of students during the event and each group had a different crime at hand. One group focused on fake identity, and it required students to evaluate different documents. After looking at the documents for any suspicious acts, they went to a fake post office to discuss the individual who may be at fault for having a fake identity. Identity theft was the focus in another group. Students gained permission to investigate a subject’s car where they discovered social security numbers and treasury checks. The last group was responsible for solving a tax fraud case where someone had written fake statements for their tax returns. The IRS gave them gear to arrest the suspect and search for any more evidence.

Not only is learning in the classroom vital for a successful education, but as well as real experience in the field. Simulations like “Special Agents: Angola” provide students with an idea of what a career might look like in just a day. It gives them the opportunity to take what knowledge is learned in the classroom and apply it to a realistic situation.

Here are some testimonials for what some students, faculty, and even an IRS agent had to say about the simulation that took place:

Caitilin Mann interviewed one student, Payton Scott, on what she thought about the experience. Payton said, “that the academy day helped her get a better understanding of the operations in the IRS, because of the hands-on experience the students were able to get”.

For a lot of students, this was a great reminder of why they are pursuing the major that they are and what they can look forward to upon graduation and entering the workforce.

Another question Caitilin had Payton consider, is if she would recommend this experience to other criminal justice students. This is what Payton had to say, “I would definitely recommend this experience. It was a lot of fun, and helped me gain real world experience in criminal investigation and helped me understand a bit more about the IRS. If anything, it’ll help you learn whether or not you’re interested in that field of work and gives you great job connections for when your academic career at Trine has come to an end.”

During the end of the day, Jackie Delagrange, the Department Chair of Criminal Justice and Psychology was observing the students. Communication and English student Sage Scherzer asked her, “What do you want the students to gain from today’s simulation?”

To which Jackie provided a thoughtful response. “I’m hoping the students will gain real world experience and how can they apply it. They are learning search warrants, arrest warrants, probable causes, how to do investigations- we talk about all of that in class, but they get to actually implement these skills into a real scenario that is set up, which is really nice. I’m hoping that they get to learn things you should and shouldn’t do with these practices.”

As the students wrapped up breaking into a classroom with a search warrant, looking for evidence and arresting the suspect, Sage talked to one of the IRS agents to end the day, “What does this event mean to the students, and what does doing it mean to you?”

To which she explained that it allows the students to get an idea of what the IRS does, because not many people know, and it allows the students to learn about federal investigation and how it is done. She also emphasized that she hopes students understand that IRS is in the federal system, so they get that knowledge base, and it gives them a better idea of what this law enforcement does in general. For her and her team, it provided recruiting potential and teach the students about what they do. She said it was a lot of fun to come in.